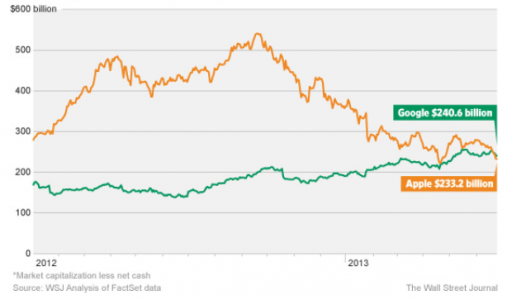

Rivalitatea dintre Apple si Google atinge un nou punct important, compania producatoare a sistemului de operare Android „devenind”, mai valoroasa decat Apple, insa totul printr-un mic artificiu. Cei de la Wall Street Journal sustin ca daca luam valoarea capitalizarii bursiere a companiei Apple, scadem cele 145 de miliarde de dolari pe care compania le are in banci si investitii(si 45 de miliarde de dolari pentru Google), atunci Apple are o valoare mai mica decat cea a Google. Practic WSJ considera ca valoarea capitalizarii bursiere reprezinta valoarea pe care piata i-o ofera unei companii, plus banii si investitiile, iar daca inlaturam acele sume, ajungem la „adevarata” valoare a acelei companii.

But the market caps of both companies are swelled by their huge bank accounts. Strip out Apple’s $145 billion of net cash as of March, and Google’s $45 billion. This leaves an enterprise value of $233 billion for Apple, but $241 billion for Google, reflecting the underlying value of the companies’ actual operations. Another way to think about it: If you bought a house for $378,000, but there was $145,000 of cash lying on the living room floor, all you really paid was a net $233,000.

Ca sa fiu sincer, cei de la WSJ au dreptate in felul lor, faca o analogie destul de ciudata, spunand ca daca achizitionam o casa cu 378.000$ (378 miliarde $ fiind valoarea actuala a capitalizarii Apple), iar in casa gasim 145.000$(banii din banci si investitii), atunci practic am cheltuit 233.000$ pe acea casa(valoarea „reala” a celor de la Apple). Voi ce parere aveti, e corecta o asemenea gandire?

Offtopic : ZF face la fel. Faza ii ca nu te opreste nimeni sa google-uiesti informatia.

Cei de la WSJ stiu un pic mai multe despre buse si bani dacat noi 😀 Eu de circa un an incerc sa inteleg tot ce scriu ei pe site-ul lor. Eu zic ca partial au dreptate. De ex top 300 cei mai bogati ramani. Le socotesti cash-ul din buzunar? Sau de ex cum a facut Particiu o afacere de millione de euro. Cu 5 minute inaite cat valora?

@Opici si @Matrice chiar nu va obliga nimeni sa intrati pe acest site, blog, „dictionar” sau cum doriti sa-i mai spuneti.

Prea mult offtopic pentru nimic. O sa fie si mai nasol maine cand membrii o sa primeasca ceva ce nu e accesibil pe Google.

Romeo, nu ii obliga nimeni dar revin si de regula doar sa arunce cu amenintari de „parasire” si dezamagiri. Este absolut normal sa se faca zeci de concursuri pt.care nu platesc, este absolut normal sa asteapte sa citeasca informatii elaborate de tip „dictionar” cand apare un update, sa intrebe si sa primeasca raspunsuri si este absolut normal ca, dupa 3 ani, pentru 13 lei sa se faca atata tam-tam. E normal, e neasteptat, e de neinteles, e romanesc. Totul li se cuvine!

Multumim totusi celor care inteleg si sustin ceea ce se face aici! Sa nu ii fie nimanui teama pt. ca nu se face avere ci doar se tine site-ul pe picioare, platindu-se diferite chestii. Si cu asta eu inchei pentru ca oricum vor fi putini cei care realmente pricep ca site-ul nu traieste cu aer si nici zaone.

Aplauze

Nu e o problema de pareri aici. Asa se calculeaza la modul pachet valoarea/costul unei companii iar aia de la wsj si ft nu sunt amatori. Mai mult, pentru cunoscatori, se mai aplica si un haircut variabil in functie de anumiti factori (piata, produse in portofoliu si proiectie a veniturilor pe termen mediu) care da si mai jos valoarea unei companii listate pentru ca in viata reala nimeni nu cumpara o companie la valoarea capitalizata bursiera (pentru o companie gen apple valoarea aia nu are mare importanta ca banii aia nu ajung la ei ci se plimba intre neni care fac arbitraj/specula cu actiuni) ci la un pret mult, mult mai mic.

Nu e corecta analogia. E ca si cum acei bani din conturi nu au fost obtinuti in urma eforturilor colective de a face din companie un brand valoros. Asadar, iar o miscare idioata impotriva „celui din topul piramidei”.

Daca as fi superiorul celui care a scris articolul ala de teapa ziarului Libertatea, i-as fi acordat un bonus mustrare materiala

Mai mult sau mai putin, graficul e strans legat de moartea lui Jobs.

e vorba de muult mai mult decat atat, de bani care sunt investiti (vezi google), de capital…apple se mentine in top pentru ca are profit extraordinar de mare (investitii prea putine, servicii prea mici) dar daca stai sa analizezi google e de 5 ori mai mare ca apple.

Daca ajungeti sa comparati apple cu google e grav….google e prea vechi si are mult prea multe investitii si firme cumparate ca sa faceti comparatia doar pe profit, insa daca as alege sa cumpar 10 actiuni le-as cumpara la google…..are ani in spate de istorie si se tine extraordinar de bine pe toate partile.

Pe langa asta (pentru lindic*i de clasa a 4-a) stiati ca google detine numeroase backbone-uri transoceanice? aka voi sunteti la cheremul lor? cautati diverse chestii si o sa aflati ca google s-a bazat bine de tot pe tot ce inseamna internet, aceasta este si cauza pentru care apple incearca sa ii dea la oparte, pentru ca depind de ei fie ca vor fie ca nu.

Inca o chestie, Apple poate fi catalogata ca o BULA, precum HI5 si Facebook (bule care inca exista riscu sa dispara), google in schimb a ajuns sa reprezinte internetul, ati fi snobi sa spuneti ca internetul era la fel fara google, toate site-urile se schimba zilnic ca sa fie mai sus in google…. Cati dintre voi cand intrati aici dati search pe google idevice.ro ? :))

Deci teoretic nu conteaza care e mai valoroasa pe bursa, apple e producator de ceva fizic+servicii, google ofera servicii, deocamdata pana apare google glass :))))